Knowing your way around a cheque can come in really handy, even if it feels like an ancient art form.

Chances are you don’t write very many cheques. Debit cards, Interac e-Transfer† transactions, credit cards and other payment methods have pushed cheques to the fringes, but they’re not gone completely. You may need to write a cheque some day and it’ll be helpful if you know how it’s done. Here’s a breakdown of the different parts of a cheque and what you do with them:

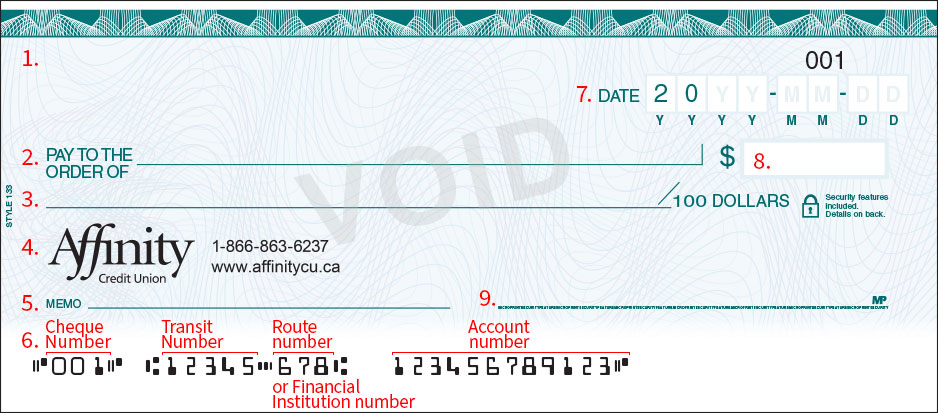

- This is the drawer’s information. When you write a cheque you’re the drawer, so your information appears here.

- This is where you write the name of the business, organization or person the cheque is written to.

- Write the cheque amount in words here. For example $50 needs to be written as ‘Fifty Dollars’.

- This is the drawee’s information. Your financial institution is the drawee.

- This is space for a memo in case you want to include a description for the cheque. This helps with record keeping.

- This is micro-encoding, or simply put, numbers that make it possible for the cheque to be read and sorted by a machine. The different sets of numbers communicate different information, like your cheque number, transit number, route number and account number. The route number is sometimes called a bank number or a financial institution number.

- The date goes here.

- Write the cheque amount in numbers here.

- Sign your name here to make the cheque official. It can’t be cashed if it’s not signed.

Cheques take time to clear your account. This is called a holding period. In this time, the money moves from your financial institution to the one where the cheque recipient banks. If you’ve written a cheque, it’s important not to forget that the amount will be coming out of your account. If you spend that money before the cheque clears, the cheque could bounce.

If you’ve deposited a cheque, keep in mind that even if you see the money in your account the cheque may not have cleared the issuers account yet. Your financial institution may give you access to part or all of that deposited cheque before it clears, but if the cheque bounces you’ll have to pay back any of the money you’ve accessed.

Balancing your chequebook sounds old school but it can help you deal with holding periods. Chequebook registers – the lined notebooks that come with your cheques – are one good way to keep your chequing account balanced. Computer spreadsheets and mobile cheque-balancing apps are two more modern options.

An accurate and up-to-date chequebook register can help protect against fraud and bank errors. It gives you a separate record of your expenses to compare against your monthly bank statement. Include debit card payments, ATM withdrawals, online bill payments and direct deposits on your register to make it into a great budgeting tool.

If you’re looking for more information on how cheques work, our Contact Centre will be happy to help you out. Call them at 1.866.863.6237.

†Interac e-Transfer is a registered trademark of Interac Inc. Used under licence.